Impact of French expatriation bonus on taxable income

Impact of French expatriation bonus on taxable income

Section 155 B of the General Tax Code allows employees falling within the scope of "impatriates" to benefit a specific abattemment 30% of their remuneration subject to income tax, and this during 5 years (Parliament could lengthen this period of additional 3 years - Les Echos july 2016).

Eligible beneficiaries are the employees officers, employees frame, top athletes (footballers known), recruited by French companies from abroad.

Since Brexit, 5 leaders of major financial firms have already contacted us to relate them with specialized tax firms.

The initial objective is to strengthen the attractiveness of the country and encourage the installation in France of high-level executives.

The requirements

The persons concerned should not have been tax resident in France during the five calendar years preceding their taking office.

They benefit in this case from the exemption for the years in respect of which they are tax residents in France within the meaning of a and b of 1 of Article 4 B of the CGI,

Besides employees, eligible people are all leaders, mentioned in 1, 2 and 3 of Article 80 b ter of the CGI, they are tax-related. These are:

- In limited liability companies or the simplified corporations (SAS), Chairman of the Board of Directors, the CEO, the deputy CEO, the interim managing director, members of the Management Board and any director or Member of the Supervisory Board for Special Assignments;

- In LLCs, minority or egalitarian managers;

- In other undertakings or establishments liable to corporation tax, officers subjected to the taxation of employees.

Note: people from exercising a job in France on their own or have already established their residence in France in recruitment, remain excluded from the special tax regime for expatriates.

The employee (or executive) should therefore be able to provide justification that when he was recruited, his real home was still attached abroad and it had not been transferred to France. This justification can result from multiple documents: vouchers contacts with the company, proof of domicile, proof of trips, family circumstances etc ...

The company in which the employee or officer has a job in France must be drawn, that is to say, it must have in France of its head office or an establishment. The legal form of this home business matter.

The actual amount of the premium must be clearly listed in the contract of employment or term of office of the persons concerned or, if necessary, in an addendum to it, drawn up before taking office in France.

Calculating the expatriation bonus

In case of option for the package, the expatriation bonus is deemed equal to 30% of the total net remuneration, that is to say the net pay social contributions and deductible from the general social contribution ( CSG), but before application of the 10% standard deduction for business expenses or, where applicable, the deduction of expenses. This compensation includes all bonuses and allowances provided for in the contract and taxed according to the rules applicable to salaries and wages in the conditions of ordinary law, with the notable exception of amounts paid or gains as part of savings schemes salary or employee share ownership.

In particular, payments under the collective participation of employees in the business and gains from the exercise of stock options ("stock options") do not constitute remuneration for fixed assessment expatriation bonus. It is the same advantages resulting from the allocation of free shares under the provisions of Article 80 of the CGI quaterdecies.

To claim the benefit of these relaxations, the impatriate must produce a certificate from the employer specifying the method by which it determined the reference remuneration. The employer must have accurate and substantiated elements which must be produced at the request of the tax service as part of the exercise of its power. In the absence of this certificate, or, where applicable, for lack of response to requests from the administration, impatriée person can not benefit from these relaxations.

Example: An employee part by a US company is posted by his company from a French company to do business in France on the basis of a contract with a net annual salary of € 200,000 including an "expatriation bonus" of € 60,000.

The "extra pay linked to the expatriation", or € 60,000 is exempt:

- Either in full if the person that the "reference salary" in France is equal to or less than the net earnings excluding bonuses the employee impatriate (€ 140,000);

- Or a maximum of € 50,000 if the comparable net wage in France is € 150,000. Indeed, the taxable wage in France can not be lower than that used in respect of similar functions by the French company or, failing that, by similar companies based in France.

In addition, contributions by stakeholders, both in the statutory social security as their home state supplementary pension schemes and supplementary insurance, mandatory or optional, to which they were affiliated before taking office in France are deductible from taxable earnings for expatriate employees.

The temporary nature of the exemption concerns both the exemption of certain elements of compensation - "expatriation bonus" and part of the remuneration corresponding to the activity carried on abroad - that the exemption of certain "passive income "and certain capital gains from sale of securities and corporate rights.

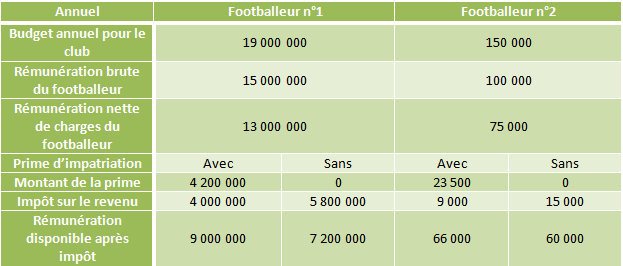

Comparison of two professional footballers, one enjoys a reputation and qualities "immeasurable", his name is Zlatan, it is paid up to 15 million euros per year, the other much less media, wins annual salary of 100,000 euros per year.

executive compensation: impact of expatriation bonus compensation of footballer

After analysis, Zlatan save € 9 million over 5 years thanks to the expatriation bonus. The second footballer, he will receive a benefit of EUR 30 000 over 5 years. This study may have an impact on the transfer of a foreign player in the championship of France, especially if the club wishing welcome does not have the budget for.

For the record, the 75% tax on salaries exceeding € 1 million no longer exists.

Furthermore, it will implement optimization devices remuneration and its social protection enabling it to reduce its fiscal and social pressure.

Complete the form below to get an online simulation

Les 4 chiffres clés de la rémunération de

Les 4 chiffres clés de la rémunération de  Impact of French expatriation bonus on taxable income

Impact of French expatriation bonus on taxable income