Appropriate status for the entrepreneurs, business owner and manager in France

In this article, we will discuss the financial and social impacts of different manager statuses . It is important for the manager to choose the most appropriate given its wishes.

- First, reduce cost company , an important element to start a business.

- Second, maximize immediate remuneration, the net in the pocket.

- Third, maximize indirect remuneration, retirement and provident rights.

We invite you to view the article entitled the remuneration key figures of the manager.

Now, back on the tax and benefit systems of the 3 main statuses in France.

The first status is the simplest, it is the individual company status. The manager is fiscally and socially imposed on its benefits , it is not the least expensive , we will see it in an example later.

The second status is the company manager subject to corporate tax, either as minority manager or majority manager, this last status appears less expensive for the company.

The third status is the employee status (CEO, senior executive ) , it is the most expensive status for the company.

Now, numerical examples that you can make with simulation tools statuses that you can find on the market. That said , you can also make the calculations by hand.

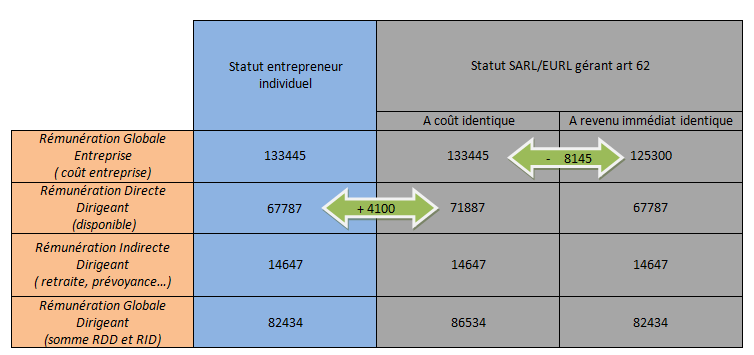

First, comparison between the individual status and a majority manager status in a limited liability company

As can be seen from the board , for a same global cost of € 133,445 , an individual manager will receive an immediate remuneration of € 67,787 , less than a majority manager, indeed , the majority manager remuneration will amount to € 71,887, it is € 4,100 higher and, this, with the same social protection coverage .

Moreover, if we maintain the same immediate remuneration € 67,787 , you realize that the global cost is now lower in the case of the majority manager. It is less expensive from € 8,145.

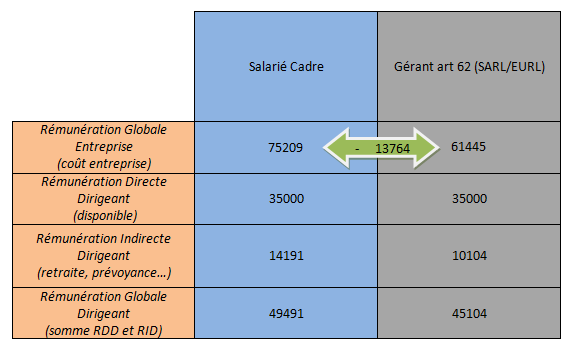

Second, comparison between employee status and a majority manager status

We can notice that the employee status is very heavy for the budget of the company , in fact, for an equivalent disposable remuneration , the difference in remuneration cost is € 13,764 .

Employee status manager is well suited when the company already has a significant amount of treasury , but a company wishing to reduce the remuneration cost should opt for the majority manager status while adding additional contracts like Madelin insurance to fill the gaps in social protection coverage, minus € 4,087 for retirement and provident rights .

All things being equal , the final annual gain for a disposable income of € 35,000 is € 9,677 . This calculation can give some reflexions in relation to a trend of systematic return to employee status.

These examples clearly show the interest to simulate the costs of each status having regard to the client's financial goals. However , the overall cost is only part of the reflection , we must also consider the legal and economic objectives of the manager.

If you found this article interesting, thank you to make our promotion on social networks

Les 4 chiffres clés de la rémunération de

Les 4 chiffres clés de la rémunération de

Appropriate status for the entrepreneurs, business owner and manager in France

Appropriate status for the entrepreneurs, business owner and manager in France